Last month’s cash rate cut by the Reserve Bank of Australia (RBA) prompted property prices to increase to a record high in May. Experts expect housing values to continue rising throughout the year.

To find out about your borrowing capacity or to get the ball rolling with pre-approval on your finance, get in touch today.

The RBA cut the cash rate by 0.25 percentage points to a two-year low last month – the second cut this year. The official cash rate is now sitting at 3.85 per cent.

In response, all of the big four banks and many other lenders reduced their variable home loan rates.

For those with a $500,000 loan, the reduction equates to a saving of around $76 a month in repayments, while a mortgage holder with a $750,000 loan would save about $114 a month.

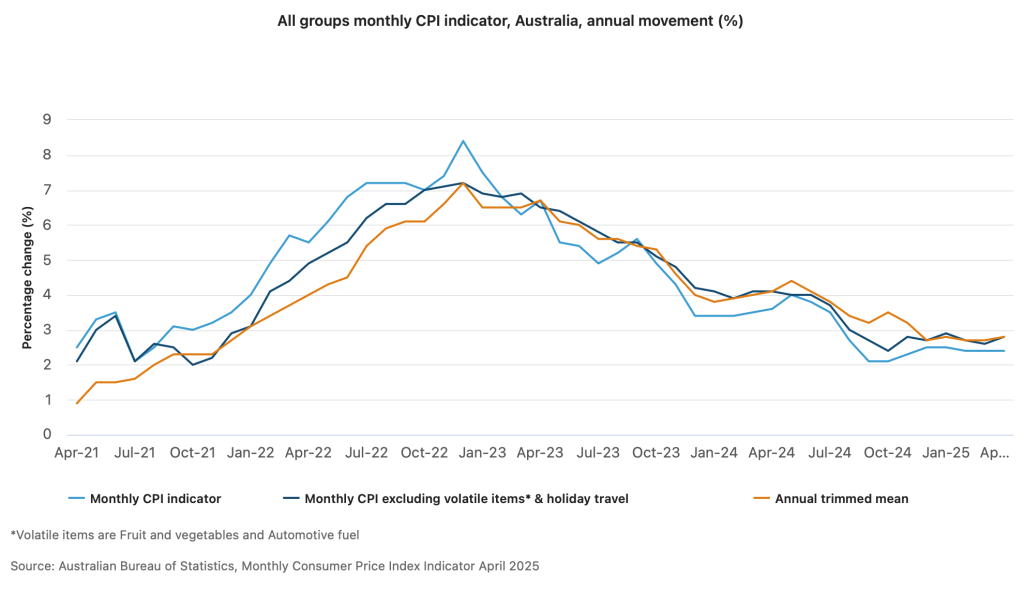

The latest figures from the Australian Bureau of Statistics showed the Consumer Price Index (CPI) rose 2.4 per cent in the 12 months to April.

Meanwhile, annual trimmed mean inflation – the figure the RBA likes to closely watch – was 2.8 per cent in April, up from 2.7 per cent in March.

The RBA’s next monitory policy decision will be announced on July 8.

Property values rose 0.5 per cent in May, according to Cotality (known previously as CoreLogic).

Every capital city recorded a positive change of at least 0.4 per cent through the month. Meanwhile, auction clearance rates picked up following the RBA’s cash rate cut.

“The continued momentum we’re seeing across almost all markets is no doubt being fuelled by rate cuts – both those that have already happened, but also potential cuts in the coming months,” said Cotality research director Tim Lawless.

“With interest rates falling again in May, we are likely to see a further positive influence flowing through to housing values in June and through the rest of the year.” Regional property prices are also on the rise.

| All dwellings | Auctions | Clearance Rate | Private Sale | Monthly home values change |

|---|---|---|---|---|

| VIC | 482 | 64% | 1607 | ▲ 0.4% |

| NSW | 838 | 53% | 1785 | ▲ 0.5% |

| ACT | 69 | 67% | 92 | ▲ 0.4% |

| QLD | 228 | 45% | 1193 | ▲ 0.6% |

| WA | 8 | 38% | 652 | ▲ 0.7% |

| NT | 3 | 33% | 39 | ▲ 1.6% |

| TAS | 0 | 0% | 146 | ▲ 0.6% |

| SA | 103 | 64% | 317 | ▲ 0.4% |

If you’re in the market to purchase your first home, next home or an investment property, winter can be a favourable time to buy. There’s usually less competition among buyers and vendors may be more motivated to lock in a sale.

To explore your finance options, get in touch. We’ll run through your financial situation and line you up with a home loan that suits your specific needs.