Interest rate news

At its June meeting, the Reserve Bank of Australia (RBA) decided to make a long-awaited cut to the official cash rate, reducing it to 1.25% – the lowest in Australian history. This was the first rate move the RBA has made since August 2016 and it was widely predicted by economists and market analysts. At least one, but possibly two, further cuts to the official cash rate are expected before the end of the year, which would be great news for homeowners and those looking to get a leg up the property ladder while homes are more affordable.

During May, many banks reduced interest rates in anticipation of today’s RBA move. Additionally, the cost of funding has fallen considerably for lenders in the past few months, which has made them more generous about reducing home loan interest rates for both homeowners and new borrowers. There are some very competitive rates available now, particularly on fixed rate loans, so call us if you’d like us to check your interest rate.

Home value movements

During May, falls in home values slowed considerably compared to recent months. Tim Lawless, Head of Research at CoreLogic, predicts that the softening in home values is likely to continue at this reduced rate until the end of 2019.

However, a renewal of confidence in the property market following the Federal Election seems likely, now that Labour’s plans to change negative gearing and capital gains tax for property investors are no longer on the table. The Australian Prudential Regulatory Authority (APRA), has also relaxed its policies on loan serviceability assessments and interest-only lending, which should help to make borrowing easier for property investors and those who may have found it harder to qualify for a home loan over the past year.

Property market activity

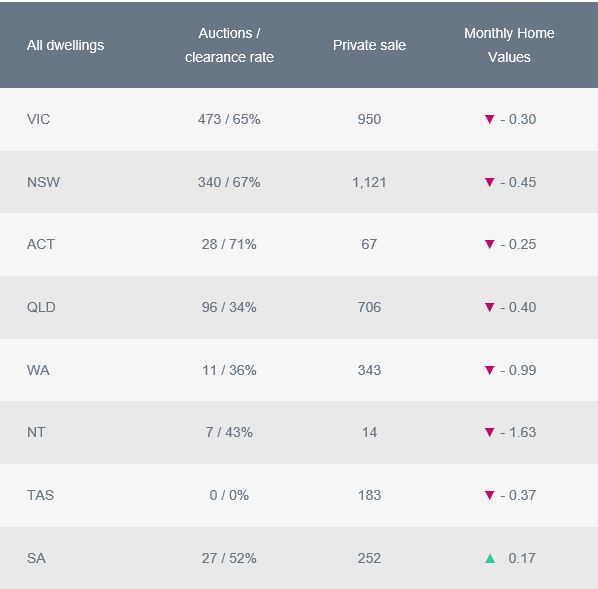

After the Federal Election, Autumn property market activity increased considerably, with a larger number of homes sold via private sales in both Melbourne and Sydney than usual. The table below shows property market activity as at June 2, 2019.

If you’re in the market for a bargain, see us about a pre-approval!

Even though winter has arrived, there are still many homes up for sale and it may be a great opportunity for you to negotiate the price on the home you want. It pays to enter negotiations armed with a pre-approval on your home loan, so if you’re in the market to buy a home please call us today to find out more. It’s also the busy time of year for car sales and business equipment purchases, so just let us know if you need help with finance and we’ll help you get it organised quickly before the end of the financial year.