Interest rate news

The Reserve Bank of Australia (RBA) announced it has decided to keep the official cash rate unchanged at 0.25 per cent at its meeting on the 7 July.

According to the RBA, the leading indicators have generally picked up recently which suggests that the worst of the global economic contraction has now passed. However, RBA governor Philip Lowe said the outlook remains uncertain and the recovery is expected to be bumpy and will depend upon containment of the coronavirus.

Home value movements

Home values remained low in June as market activity continues to show improvement from April. The Home Value Index report from CoreLogic shows the estimate of home sales activity in June was up by 29.5%. Tim Lawless, CoreLogic’s head of research, said “The downwards pressure on home values has remained mild to-date, with capital city dwelling values falling a cumulative 1.3% over the past two months. A variety of factors have helped to protect home values from more significant declines, including persistently low advertised stock levels and significant government stimulus. Additionally, low interest rates and forbearance policies from lenders have helped to keep urgent sales off the market, providing further insulation to housing values.”

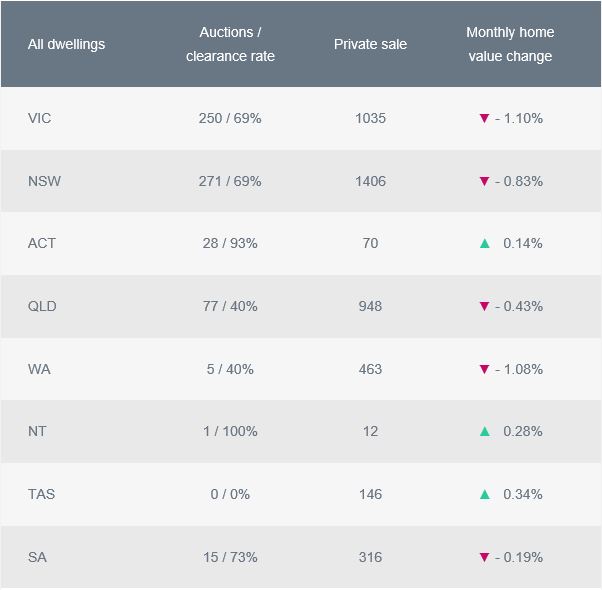

The five largest capital cities have recorded a decline in home values over the month. Melbourne has posted the largest fall over the month, down at -1.1% in June. Home values were also down in Perth (-1.08%), Sydney (-0.83%), Brisbane (-0.43), and Adelaide (-0.19%), but slightly rose in Hobart (+0.34%), Darwin (+0.28%) and Canberra (+0.14%).

Property market activity

We’re here to help you achieve your property goals

The interest rates will remain low for a while, so now could be the time to secure the property you want at a competitive price. To secure a home loan pre-approval so you’re in a strong position to negotiate, please get in touch with your broker.