Interest rate news

The Reserve Bank of Australia (RBA) held its first board meeting on monetary policy for the year on February 4. The board decided to leave the official cash rate on hold at 0.75 per cent. Last year, we saw three cash rate drops and many lenders adjusted their rates accordingly. If you’ve been with the same lender for a while, it’s worth asking us to review your current home loan – we might be able to save you money by negotiating a better rate on your behalf as there are incredible deals available.

Home value movements

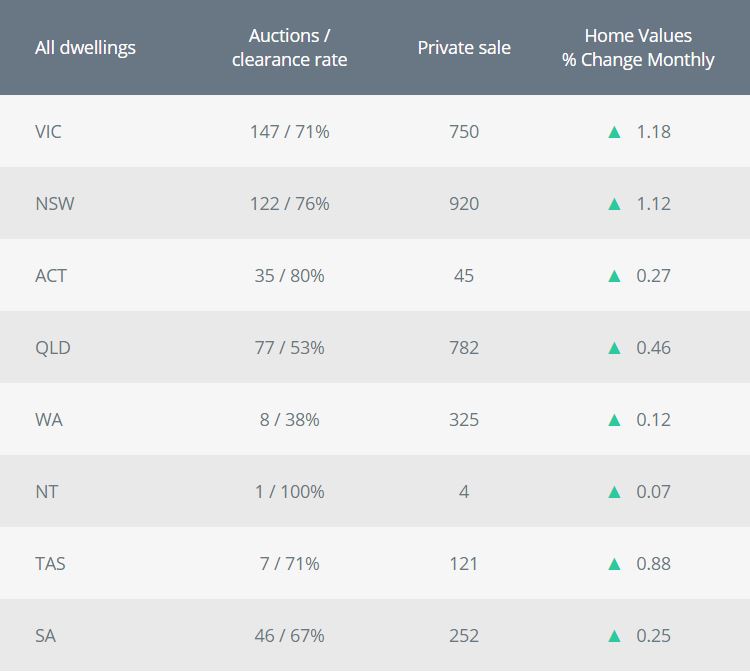

In exciting news for homeowners, housing values rose across every capital city in January. According to CoreLogic figures, dwelling values increased across all capitals by 0.9%. CoreLogic head of research, Tim Lawless, said the housing recovery which began in Sydney and Melbourne was now spreading to other areas of the country.

Property market activity

As expected for this time of year, auction activity has been slow in recent weeks.

* Monthly Home Values figures as at January 31, 2020.

* Australian auction results, clearance rates and recent sales for the week ending February 2, 2020. The clearance rate is preliminary and current as at 12:50pm, February 3.

If you’re in the market to buy a home or investment property, now is the time to speak to us about your finance options. We offer tailored finance solutions, no matter what your goals are in 2020. Please give us a call and we’ll find the right home loan or investment loan for your specific needs.

Sources:

https://www.realestate.com.au/auction-results/

https://www.corelogic.com.au/research/monthly-indices

https://www.corelogic.com.au/news/corelogic-december-2019-home-value-index-strong-finish-housing-values-2019-corelogic-national

https://www.corelogic.com.au/news/corelogic-january-2020-home-value-index-housing-values-rose-across-every-capital-city-january