The RBA delivered the second cash rate cut for 2025 in May, bringing it down 0.25 percentage points to 3.85 per cent.

Meanwhile, property prices across the nation edged higher in April, despite uncertainty from President Donald Trump’s tariff announcement and the federal election.

If you’re wondering what this means for your borrowing capacity or to get the ball rolling with pre-approval on your finance, get in touch today.

At its third meeting for 2025, the RBA decided to cut the cash rate to 3.85 per cent.

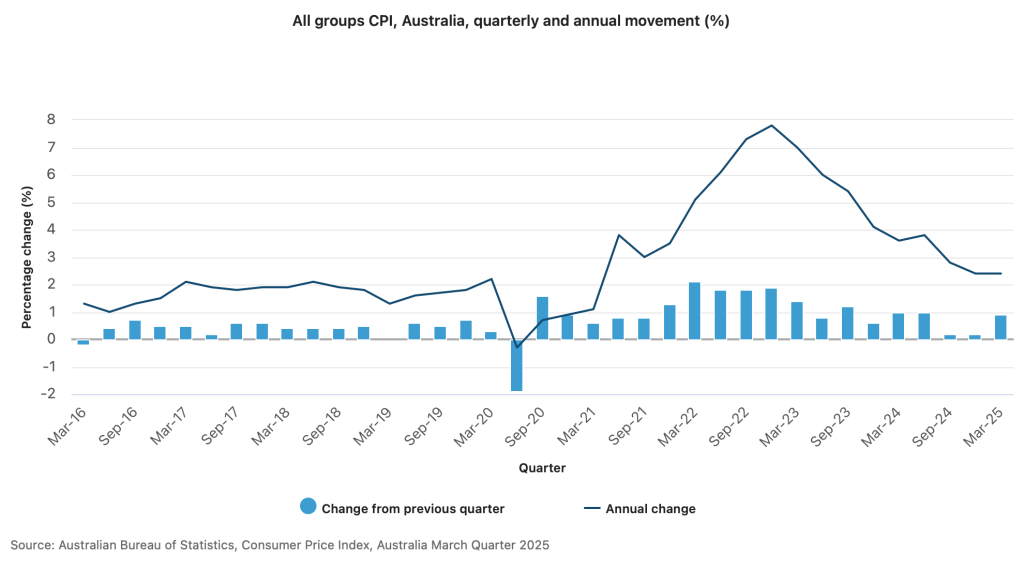

The latest figures from the Australian Bureau of Statistics showed the Consumer Price Index (CPI) rose 2.4 per cent over the 12 months to the March quarter.

Meanwhile, underlying inflation, as represented by the trimmed mean, fell to 2.9 per cent for the March quarter, down from 3.3 per cent in the December quarter. That’s the lowest it’s been since December 2021.

The latest inflation data left many economists almost certain of more interest rate relief to come. “We’ve come a long way and it hasn’t been easy, but we have made good progress on bringing inflation down and keeping unemployment low,” RBA Governor Michele Bullock recently said.

“This is a good position for the economy to be in as we approach a period of uncertainty.”

“The Board will continue to look at the data to assess if the economy and inflation continue to evolve as expected.”

It’s widely expected we will see more cash rate cuts as 2025 unfolds, with some saying there could be up to five in total this year.

Even before the latest cash rate announcement, lenders had started cutting mortgage interest rates. With so much movement, now is the time to shop around.

The latest cash rate cut is also expected to drive an uptick in refinancing. Data released by Money.com.au found that one in three borrowers would be open to fixing their loans if the cash rate went down again in May, which it did.

To review your home loan or explore your finance options, get in touch today.

The next cash rate announcement will be on 8 July.

Property values across the nation continued to climb in April, with Cotality (known previously as CoreLogic) recording a 0.3% rise in values to a new record high.

Every capital city recorded a positive change, ranging from 1.1% in Darwin, to 0.2% in Sydney and Melbourne.

“The rate cut in February supported an upwards inflection in housing market conditions, but the positive influence from lower rates seems to be losing some potency,” Cotality research director Tim Lawless said.

“At the same time, household confidence slipped in April, with the US’s ‘Liberation Day’ tariff announcements and the federal election causing uncertainty.

“It is likely this may be causing some buyers and sellers to delay their decisions.” Regional housing growth continued to outpace the capital cities in April. This has been the case since October last year.

| All dwellings | Auctions | Clearance Rate | Private Sale | Monthly home values change |

|---|---|---|---|---|

| VIC | 798 | 66% | 1270 | ▲ 0.2% |

| NSW | 629 | 53% | 1550 | ▲ 0.2% |

| ACT | 53 | 60% | 93 | ▲ 0.4% |

| QLD | 167 | 41% | 962 | ▲ 0.4% |

| WA | 7 | 29% | 542 | ▲ 0.4% |

| NT | 3 | 33% | 33 | ▲ 1.1% |

| TAS | 2 | 50% | 125 | ▲ 1.0% |

| SA | 104 | 58% | 250 | ▲ 0.3% |

Winter can be a great time to purchase, with reduced competition among buyers generally and potentially motivated sellers.

To explore your finance options, get in touch and let’s talk through your purchasing plans.