Property prices are continuing to climb to record highs across the nation, while interest rates have come down again for the third time this year.

If you’re planning on a spring property purchase, chat to us now about your finance options. We’ll line you up with a home loan suited to your specific needs.

The Reserve Bank of Australia (RBA) cut the cash rate to 3.6 per cent at its latest meeting – the lowest it has been since April 2023.

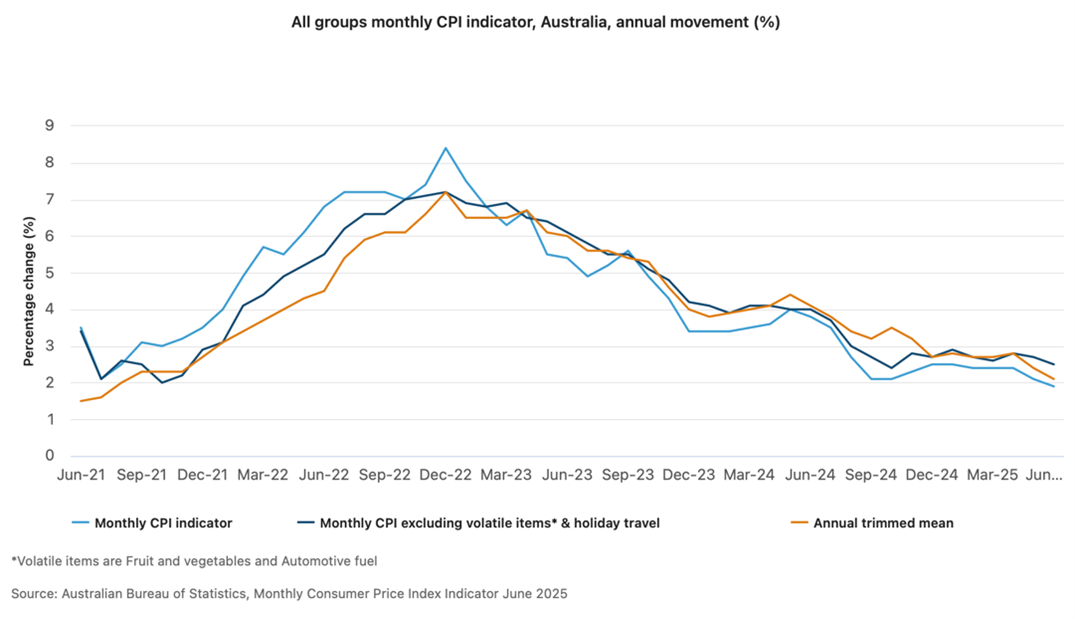

For the June quarter, CPI fell from 2.4 per cent to 2.1 per cent. Underlying inflation, as represented by the trimmed mean, dropped from 2.9 per cent to 2.7 per cent – its lowest since December 2021.

The inflation pull back, which is now tracking within the RBA’s 2-3 per cent target band alongside “labour market conditions easing slightly, as expected”, led the board to deem “further easing of monetary policy was appropriate” RBA governor Michele Bullock said.

The RBA’s latest Statement on Monetary Policy offers fresh insights into the economic and interest rate outlook. Despite markets expecting lower rates since May, the RBA’s inflation forecast remains steady, with the trimmed mean sitting at 2.6 per cent for the next two years.

Financial markets are currently pricing in a cash rate low of 2.9 per cent by December 2026 before edging back up to 3.1 per cent in 2027. If the RBA’s projections are correct, they suggest the economy can operate with a cash rate around 3 per cent and inflation will remain within their target band.

The next RBA cash rate decision will be announced on 30 September.

Australia’s national property values rose by 0.6 per cent in July, marking the sixth consecutive month of growth, according to Cotality (known previously as CoreLogic).

“That [growth] started with the cash rate being reduced in February,” said Eliza Owen, head of research at Cotality.

“Overall, it’s taken home values about 3 per cent higher through the year to date, or the equivalent of another $25,000 being added to the median dwelling value in Australia.

“And we’re seeing these gains right across the country now.”

All capital cities experienced price growth in July, with Darwin recording the largest monthly increase at 2.2 per cent.

| All dwellings | Auctions | Clearance Rate | Private Sale | Monthly home values change |

|---|---|---|---|---|

| VIC | 686 | 70% | 1266 | ▲ 0.4% |

| NSW | 699 | 62% | 1555 | ▲ 0.8% |

| ACT | 93 | 79% | 53 | ▲ 0.6% |

| QLD | 155 | 49% | 1115 | ▲ 0.7% |

| WA | 7 | 29% | 549 | ▲ 0.9% |

| NT | 2 | 50% | 21 | ▲ 2.9% |

| TAS | 0 | –% | 149 | ▼ ‑ 0.1% |

| SA | 94 | 69% | 238 | ▲ 0.7% |

Ready to buy?

Be ready to purchase when you find the right property for your needs this spring. Talk to us about finance pre-approval today.

We’ll get to understand your financial situation and goals, then line you up with the finance that suits your needs. Let’s start the conversation.