In June, property prices continued their upward trend, rising 0.6% across the month. Experts say the growth can be attributed to the cash rate cuts earlier this year and limited housing supply.

With the new financial year kicking off, several new and expanded housing schemes are set to come into effect. To find out about your eligibility for the schemes or to explore your borrowing capacity, get in touch today.

The RBA decided to keep the cash rate on hold at 3.85 per cent at its latest meeting, leaving many economists stunned. Most were banking on a cash rate cut, given the latest inflation data.

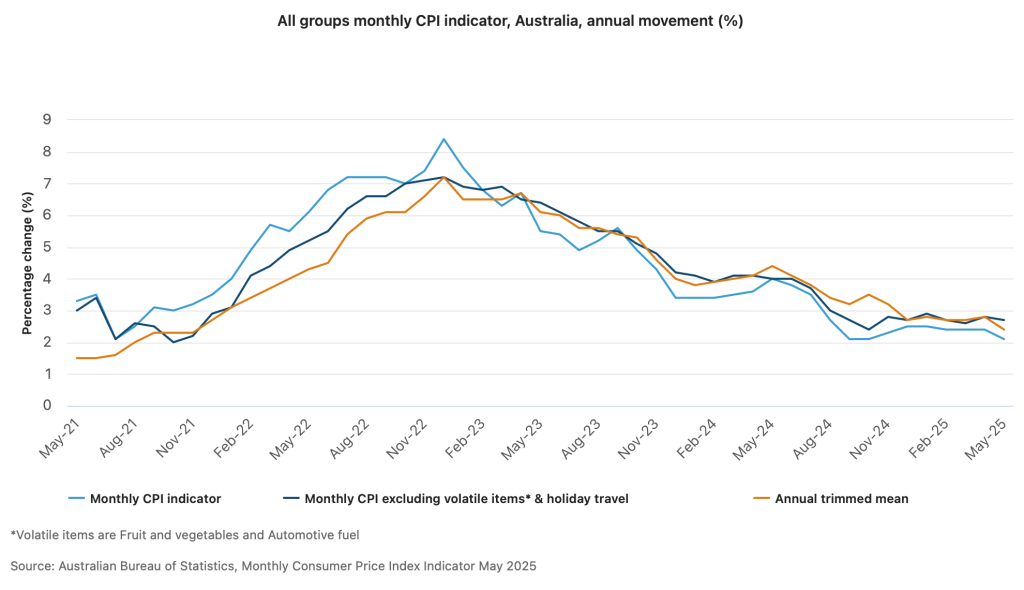

Figures from the Australian Bureau of Statistics showed the Consumer Price Index (CPI) rose 2.1 per cent over the 12 months to May, down from a 2.4 per cent rise in the 12 months to April.

Underlying inflation, as represented by the trimmed mean, fell to 2.4 per cent in May – the lowest it’s been since November 2021. That’s well within the RBA’s target band of 2-3 per cent.

The RBA board was split in its decision, with six voting to keep rates on hold, and three against, shifting away from recent consensus decisions.

Governor Michele Bullock said the board was united in its view on the direction of interest rates, just not on the timing of cuts.

Bullock said the board would wait to see if the quarterly inflation data, due out at the end of July, showed another decline before deciding on a possible rate cut.

Some economists believe the RBA’s decision to keep the cash rate steady could slow the pace of price growth we’ve seen in the property market of late. If you’re looking to buy, now could be a good time to chat to us about your finance options.

The RBA’s next monetary policy decision will be announced on 12 August. Australia’s Big Four banks all expect a cash rate cut next month.

Australia’s property values rose by 0.6 per cent in June, marking a fifth consecutive month of growth, according to Cotality (known previously as CoreLogic).

Every capital city recorded a positive change except Hobart, where property prices dropped by -0.2 per cent. The median house price in Australia’s capitals is now sitting at $1,034,806, while the median unit price is $697,233.

Falling interest rates have been a clear catalyst of the renewed momentum in housing prices, said Cotality research director Tim Lawless.

“The first rate cut in February was a clear turning point,” he said.

“An additional cut in May, and growing certainty of more cuts later in the year, have further fuelled positive housing sentiment, pushing values higher.” Lawless said advertised supply was tracking 5.8% below the same time a year ago, while auction clearance rates rose above the decade-average in the last two weeks of June.

| All dwellings | Auctions | Clearance Rate | Private Sale | Monthly home values change |

|---|---|---|---|---|

| VIC | 706 | 71% | 1486 | ▲ 0.5% |

| NSW | 815 | 61% | 1756 | ▲ 0.6% |

| ACT | 65 | 71% | 108 | ▲ 0.9% |

| QLD | 207 | 56% | 1048 | ▲ 0.8% |

| WA | 15 | 47% | 609 | ▲ 0.8% |

| NT | 5 | 80% | 22 | ▲ 1.5% |

| TAS | 1 | –% | 159 | ▼ – 0.2% |

| SA | 103 | 64% | 270 | ▲ 0.5% |

The busy spring selling season is just around the corner. If you’re planning a spring property purchase, talk to us about your finance options early.

It might be worth exploring some of the new and expanded housing schemes coming into effect this financial year. Under the Help to Buy shared equity scheme, the government will contribute up to 40 per cent of the purchase price for new homes or 30 per cent of existing homes for eligible borrowers. Buyers would only need a 2 per cent deposit and wouldn’t have to pay lenders’ mortgage insurance (LMI). Help to Buy is expected to open later this year.

Meanwhile, 50,000 new Home Guarantee Scheme places have been released this financial year:

One of the Albanese government’s election promises was to remove the income and property price caps for the First Home Guarantee, meaning that from January 2026, all first home buyers will be eligible to purchase a home with a 5 per cent deposit without paying LMI.

To explore your eligibility for these schemes, or to talk through your finance needs, get in touch today.

Let’s make your purchasing dream a reality.